(Photo: PBS)

President Obama has often repeated the claim that he cut kept his promise to cut the federal deficit in half, but that has always been a gimmick. In fact, Democratic presidential candidates are trying to one-up each other on more government spending, including free college and expanding Medicare, Medicaid and Social Security.

But a new report from the Congressional Budget Office (CBO) serves as a dire warning to the president and Congress that the “outlook for the federal budget has worsened dramatically over the past several years.” The CBO notes that the deficits under President Obama — which he claims to have cut so dramatically — are little more than budget gimmicks designed to run the clock out on his tenure. Within a few years, however, largely due to rising health care costs, ObamaCare, and an aging population promised Medicare and Social Security, deficits as a percentage of gross domestic product (GDP) will explode.

“Moreover, debt would still be on an upward path relative to the size of the economy. Consequently, the policy changes needed to reduce debt to any given amount would become larger and larger over time,” the CBO stated in the budget outlook report. “The rising debt could not be sustained indefinitely; the government’s creditors would eventually begin to doubt its ability to cut spending or raise revenues by enough to pay its debt obligations, forcing the government to pay much higher interest rates to borrow money.”

While the deficit is projected to shrink in 2015 to its smallest percentage of GDP since 2007 — CBO projects it at 2.7 percent, a much smaller percentage than the recent peak of nearly 10 percent in 2009 — the true cost of these programs have largely been delayed. The longer proponents of big government spending put off the inevitable, which is either a massive debt crisis of an end to demagoguing anyone who puts forward serious federal budget reforms — the more serious the pain will be.

“Throughout the next decade, however, an aging population, rising health care costs per person, and an increasing number of recipients of exchange subsidies and Medicaid benefits attributable to the Affordable Care Act would push up spending for some of the largest federal programs if current laws governing those programs remained unchanged,” the report says. “Moreover, CBO expects interest rates to rebound in coming years from their current unusually low levels, raising the government’s interest payments on debt.”

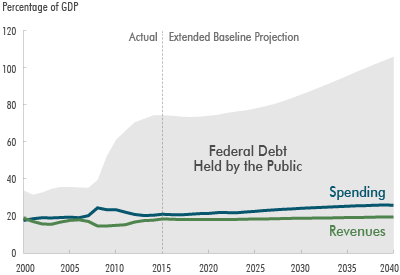

Deficits over the entire 10-year period examined by the CBO would total roughly $7.4 trillion, most which will begin to explode in the later part of the decade. From 2016 to 2021, deficits are projected to stay close to their current percentage of GDP for only the next few years before the amount of federal debt held by the public begins to jump off of the 73- to 74-percent of GDP) range. Thereafter, the larger deficits would boost debt—to 78 percent of GDP by the end of 2025.

“How long the nation could sustain such growth in federal debt is impossible to predict with any confidence,” the CBO says. “At some point, investors would begin to doubt the government’s willingness or ability to meet its debt obligations, requiring it to pay much higher interest costs in order to continue borrowing money. Such a fiscal crisis would present policymakers with extremely difficult choices and would probably have a substantial negative impact on the country.”

Here are a few predicted impacts of a budget crisis if Washington — and the American voter — do not get their acts together:

- The large amount of federal borrowing would draw money away from private investment in productive capital over the long term, because the portion of people’s savings used to buy government securities would not be available to finance private investment. The result would be a smaller stock of capital, and therefore lower output and income, than would otherwise have been the case, all else being equal. (Despite those reductions, output and income per person, adjusted for inflation, would be higher in the future than they are now, thanks to the continued growth of productivity.)

- Federal spending on interest payments would rise, thus requiring the government to raise taxes, reduce spending for benefits and services, or both to achieve any targets that it might choose for budget deficits and debt.

- The large amount of debt would restrict policymakers’ ability to use tax and spending policies to respond to unexpected challenges, such as economic downturns or financial crises. As a result, those challenges would tend to have larger negative effects on the economy and on people’s well-being than they would otherwise. The large amount of debt could also compromise national security by constraining defense spending in times of international crisis or by limiting the country’s ability to prepare for such a crisis.

It’s a dire warning, indeed. Though the CBO did a good job of sugar-coating this warning, the result is more than an abstract economic argument. In a debt crisis such as this, government promises to seniors turn into broken promises; there are no food stamps for those who need it, let along those 125 percent above the poverty line. How will that play out in our already-tumultuous, inner-city neighborhoods where the fabric of civil society now threatens to tear with each new headline?

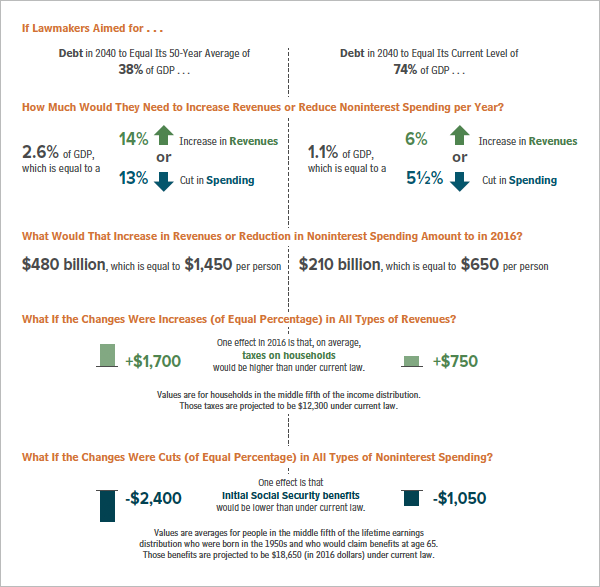

And, despite the CBO’s willingness to look at possible tax increases to solve the problem, their is simply not enough money to tax and spend our way around it. Here are a few solution scenarios the CBO put forward, but it’s important to keep in mind that many economists argue that they do not adequately factor the nearly $100 trillion in unfunded liabilities.

“Even if policy changes that shrank deficits in the long term were not implemented for several years, making decisions about them sooner rather than later could hold down longer-term interest rates, reduce uncertainty, and enhance businesses’ and consumers’ confidence,” the report states. “Such decisions could thereby make output and employment higher in the next few years than they would have been otherwise.”

Given the Democrats’ (and some Republicans’) loyalties to ideological purity over common sense, as well as the utter lack of spine, straight talk and leadership found in Washington D.C., it is easy to see why a solid majority of Americans say the country is headed in the wrong direction. Still, unfortunately, major media outlets are derelict in their duty to inform and alarm them just how bad of shape we are in as a nation.

[mybooktable book=”our-virtuous-republic-forgotten-clause-american-social-contract” display=”summary” buybutton_shadowbox=”true”]