U.S. House Speaker John Boehner, R-Ohio, speaks at a news conference on Capitol Hill in Washington on March 19, 2015. (Photo: Yuri Gripas/Reuters)

Let’s celebrate some good news. When politicians can be convinced (or pressured) to exercise even a modest bit of spending restraint, it’s remarkably simple to get positive results.

Here’s some of what I wrote earlier this year.

…one of the few recent victories for fiscal responsibility was the 2011 Budget Control Act (BCA), which only was implemented because of a fight that year over the debt limit. At the time, the establishment was screaming and yelling about risky brinksmanship. But the net result is that the BCA ultimately resulted in the sequester, which was a huge victory that contributed to much better fiscal numbers between 2009-2014.

And “much better fiscal numbers” really are much better.

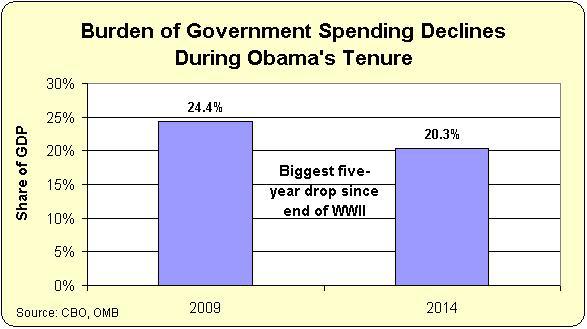

Here’s a chart I put together showing how the burden of federal spending declined between 2009 and 2014. And this happened for the simple reason that spending was flat and the economy had a bit of growth.

Federal Spending from start of Obama administration to the present. (Source: Dan Mitchell)oehner

But now let’s look at some bad news. It won’t surprise anyone to learn that the big spenders in Washington don’t like fiscal discipline. They don’t like the modest restraint required by the Budget Control Act and they want to repeal or eviscerate the law. And they’ve already enjoyed some success, replacing spending restraint with tax hikes and budget gimmicks back in 2013.

And now there’s pressure for a similar capitulation this year, led by the Committee (gee, what a shocker) that’s in charge of spending money. An article in Politico captures some of the internal dynamics.

…what should have been a dream job for House Appropriations Chairman Hal Rogers (R-Ky.) has instead become an exercise in frustration. Despite his plum position, Rogers finds himself at odds with GOP leadership… He’s calling for his party to raise strict spending caps he says are choking off necessary funding… But Rogers’ calls for a budget deal have fallen flat.

By the way, it’s not the main point of today’s column, but the article also shows why it was so important to eliminate “earmarks.”

Lawmakers no longer can be bribed to support more spending in exchange for pork-barrel projects.

It’s a reminder of the sway lost by the once powerful appropriations panel, in an age when earmarks are outlawed… The committee, once an aspiration for every lawmaker, is struggling to make its voice heard… appropriator Steve Womack (R-Ark.)…cheered Rogers for “pushing our leaders to the extent that he can” toward a budget accord. “Appropriators are in a tough spot … We just don’t have the grease that we formerly possessed.”

Good. I don’t want big spenders to have “grease” that facilitates a bigger burden of government.

But getting rid of earmarks didn’t win the war. Washington is still filled with lobbyists, bureaucrats, cronies, special interests, and other insiders who want more spending.

They want to bust the spending caps so they can line their pockets at the expense of the American people. Which is why maintaining the BCA caps are a critical test of whether Republicans are sincere about controlling Leviathan.

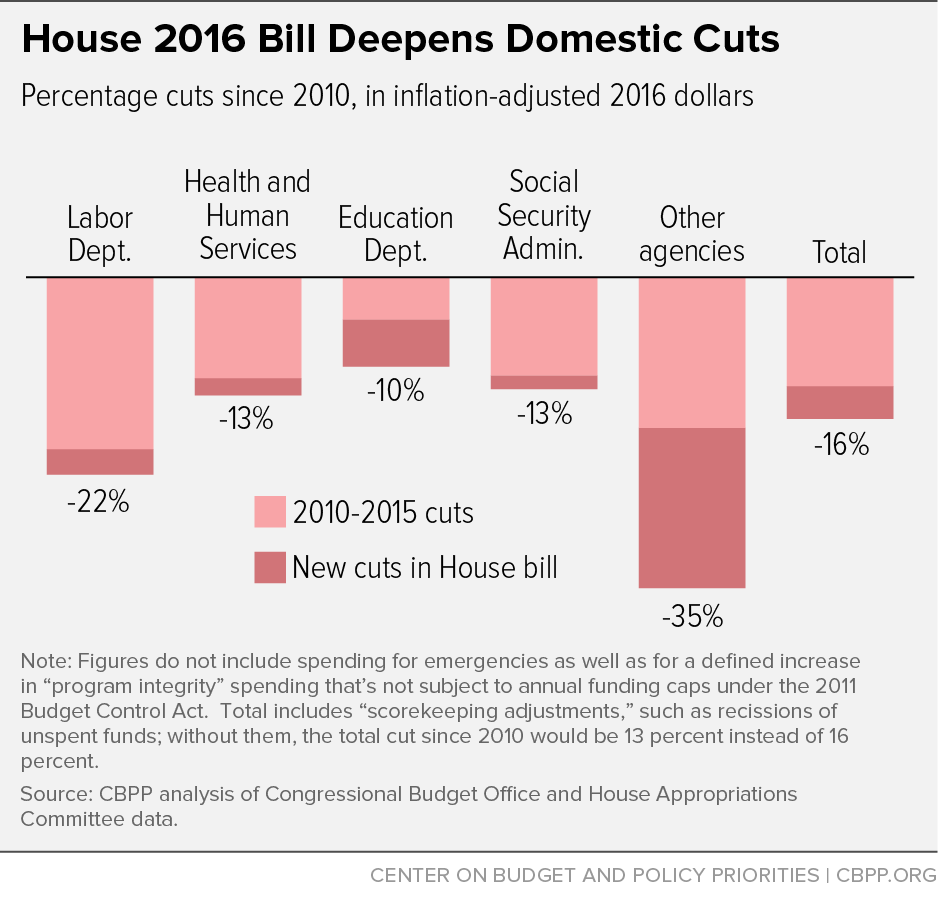

To understand the importance of the spending caps, here’s a chart from the Center on Budget and Policy Priorities, a left-wing group that supports bigger government. I won’t vouch for their specific numbers since they have an incentive to exaggerate and overstate the amount of fiscal discipline that’s been imposed, but there’s no question that the big spenders have been handcuffed in recent years.

Now that we’ve reviewed why it’s important to have spending caps, let’s talk about the elephant in the room. There are two reasons why Republicans may sell out. First, as already discussed,some of them are spendaholics. They like bribing voters with other people’s money. The second reason the GOP may capitulate is that the President and congressional Democrats may force a “government shutdown” fight. To be more specific, the annual spending (or “appropriations”) bills are supposed to be completed by October 1, which is the start of the new fiscal year.

If President Obama uses his veto pen, which is what most observers expect, there will be a shutdown. And even though previous shutdowns have yielded positive policy changes, Republicans are afraid that they will suffer political blowback.

Given that they won a landslide election in 2014 after the 2013 shutdown (and also prevailed after the 1995 shutdown fight), this skittishness is a bit of a mystery, but the conventional wisdom is that GOPers will capitulate to Obama and agree to a deal that busts the spending caps.

Which would be very unfortunate for the cause of good fiscal policy.

On the issue of big government and spending discipline, I recently appeared on John Stossel’s show, along with my colleague Chris Edwards, while participating in FreedomFest. Here’s what we said about the importance of shrinking Washington to promote freedom and prosperity.

P.S. In this video, Chris and I pontificate at greater length on fiscal policy issues.

P.P.S. While I’m critical of the politicians on the Appropriations Committee, I don’t think they’re necessarily any worse than other lawmakers. As I explained last month when analyzing the bad behavior of politicians who are on the committees that deal with transportation, the system creates a perverse incentive structure to expand government.

P.P.P.S. Here’s some government shutdown humor. And some more at the bottom of this post.