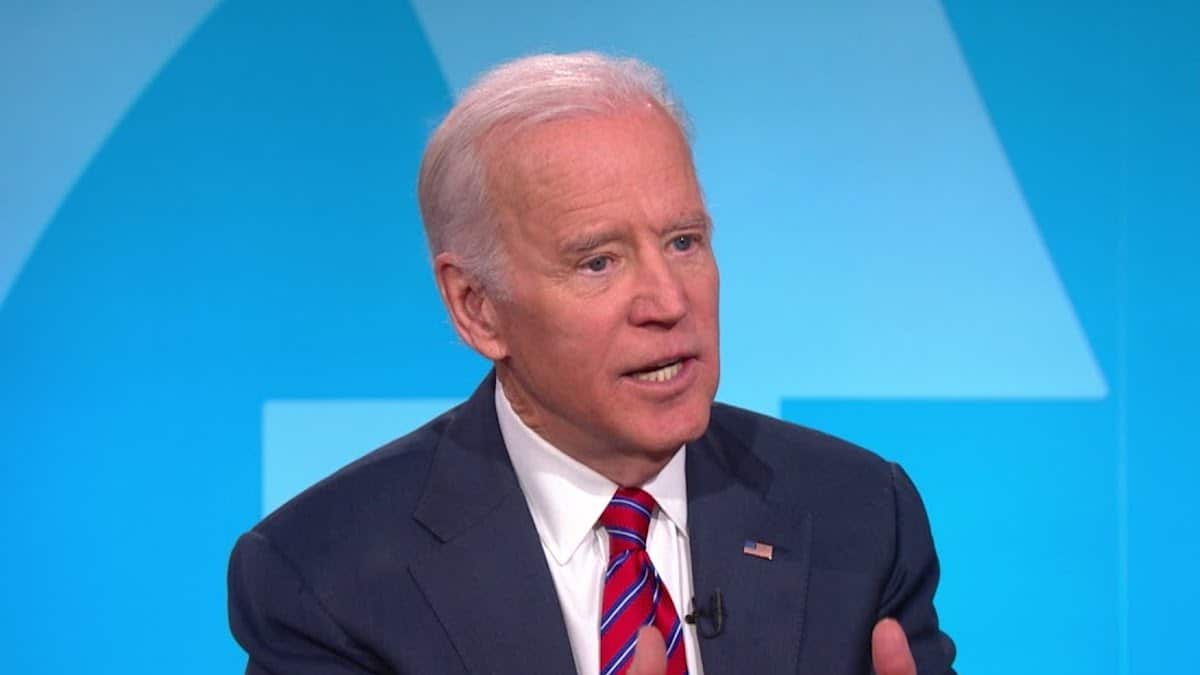

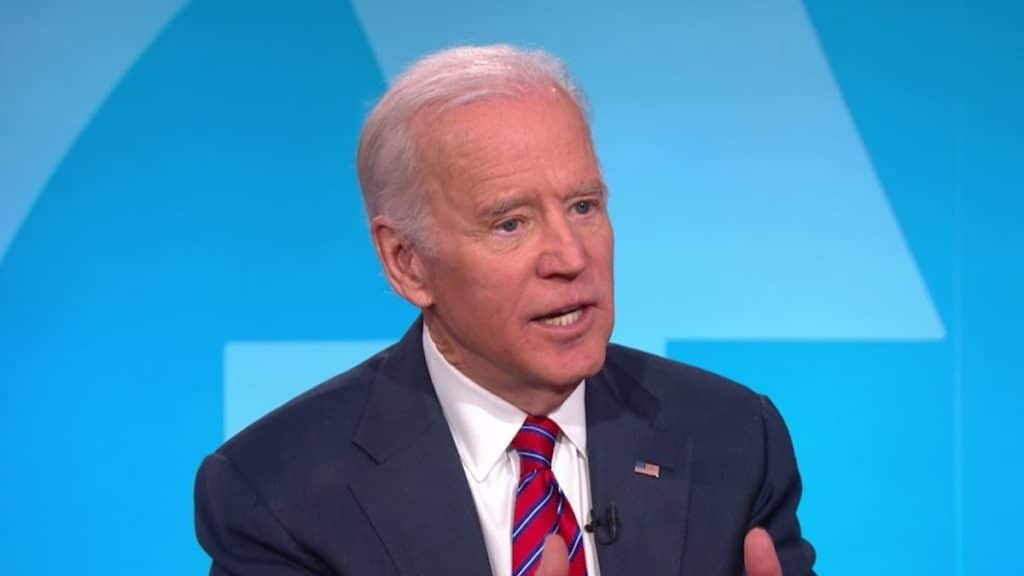

Former Vice President Joe Biden proposed a tax plan that would raise taxes, reduce economic growth and stifle wage growth, an analysis finds. The plan would rollback much of the president’s signature tax reform legislation.

According to the Tax Foundation’s General Equilibrium Model, the Biden tax plan would reduce gross domestic product (GDP) by 1.51% over the long term. On a conventional basis — more closely associated with static scoring — the plan would raise tax revenue by $3.8 trillion over 10 years.

However, when accounting for macroeconomic feedback effects — more closely associated with dynamic scoring — the plan would only raise about $3.2 trillion over the next decade. There’s further empirical evidence to indicate the campaign’s revenue projections would fall shy, the same empirical evidence that correctly predicted the president’s plan would result in strong wage growth.

In December 2017, President Donald Trump signed the Tax Cuts and Jobs Act, his first major legislative victory and the first overhaul to the U.S. tax code in more than 31 years. It provided a tax cut to more than 80% of Americans and slashed the corporate tax rate from the highest in the developed world (35%) to 21%.

Critics incorrectly projected it would lead to billions in deficits, citing static scoring from the Congressional Budget Office (CBO). Some of those critics have been forced to issue corrections, including The New York Times.

But a recent budget outlook released by the CBO found the TCJA not only did not add to the federal deficit, but resulting revenue increases actually offset deficit gains. The CBO analysis showed rising shortfalls in Social Security, Medicare, and Medicaid — as well as defense spending — are overwhelmingly the drivers of budget deficits.

People’s Pundit Daily (PPD) previously examined fifty years of data for industrialized nations, which suggest lower corporate tax rates are associated with rising revenue, as noted by Chris Edwards of the Cato Institute. Indeed, research shows the long-run revenue-maximizing corporate rate is between 15% and 25%.

Mr. Biden proposes to re-raise the corporate income tax rate from 21% set by the TCJA to 28%, a level above the revenue-maximizing range. The campaign claims Mr. Biden’s plan will raise revenue, but the analysis suggests otherwise.

On a dynamic basis, the Tax Foundation estimates the Biden tax plan would result in about 15% less revenue than on a conventional basis over the next decade. Revenue increases would total roughly $3.2 trillion between 2021 and 2030, as the smaller economy would shrink the tax base for payroll, individual income, and business income taxes.

People’s Pundit Daily (PPD) also previously examined the impact the corporate tax rate has on worker wages. A review of a report from the Council of Economic Advisers coupled with data from the Organization for Economic Cooperation and Development (OECD) showed reducing the corporate tax rate would increase average household income, with this effect growing larger over time.

Even left-leaning multilateral bureaucracies such as the International Monetary Fund (IMF) and the OECD have published research showing the relationship. Following the adoption of the TCJA and as a result of it, data from the Bureau of Economic Analysis (BEA) confirmed the greater-than-expected rise in growth for the wages and salaries component.

By the third quarter (Q3) of 2018, wage growth had hit 3% for the first time since before the Great Recession. Wages rose by at least 3% for 22 consecutive months prior to the outbreak of coronavirus (COVID-19), though the most recent jobs report for May still indicated a strong annual growth rate.

Mr. Biden’s plan also raises individual income taxes and payroll taxes on individual income taxes and payroll taxes, on high-income individuals with income above $400,000. But on a conventional basis, the Tax Foundation said the plan would lead to 7.8% less after-tax income for the top 1% of taxpayers, 1.1% lower after-tax income for the top 5%, and roughly 0.6% less after-tax income for other income quintiles.

The Tax Foundation analysis also estimated the Biden tax plan would result in the loss of at least 585,000 full-time jobs, shrink capital stock by 3.23% and reduce the overall wage rate by 0.98%.