Vermont Sen. Bernie Sanders, left, and New York businessman Donald Trump, right, talk trade at rallies in Michigan. (Photos: Getty Images)

John Cowperthwaite deserves a lot of credit for Hong Kong’s prosperity. As a British appointee, he took a hands-off policy and allowed the colony’s economy to thrive. He didn’t even want the government to collect statistics since that would give interventionists data that might be used to argue for interventionism.

I have mixed feelings about that approach. I constantly use statistics because they so often show that free markets and small government produce the best outcomes. I even use data to show that Hong Kong’s economy should be emulated.

On the other hand, there are some statistics that cause a lot of mischief.

I’ve argued, for instance, that we should focus on how national prosperity is generated (gross domestic income) rather than how it is allocated (gross domestic product). If we changed the focus to GDI, the debate would more naturally focus on pro-growth policies to boost wages, small business income, and corporate profits rather than the misguided policies (such as Keynesian economics) that are enabled by a focus on GDP.

That being said, there’s a good argument that the worst government statistic is the “trade deficit.”

This is a very destructive piece of data because people instinctively assume a “deficit” is bad. Yet I have a trade deficit every year with my local grocery store. I’m always buying things from them and they never buy anything from me. Does that mean I’m a “loser”? Of course not. Voluntary exchange, by definition, means that both parties gain from any transaction. And this principle applies when voluntary exchange occurs across national borders.

Moreover, people oftentimes don’t realize that the necessary and automatic flip side of a “trade deficit” is a “capital surplus.” In other words, when foreign companies acquire dollars by selling to American consumers, they frequently decide that investing in the American economy is the best use of that money. And the huge amount of investment from overseas is a sign of comparative prosperity and vitality, not a sign of weakness.

And for any readers who nonetheless think protectionism might be a good idea, I challenge them to answer these eight questions.

I’m confident that both Donald Trump and Bernie Sanders wouldn’t be able to successfully answer any of them. Yet it appears they’ve gained some traction with voters by calling for protectionism.

That’s quite unfortunate. If the pro-trade policy consensus in America breaks down, that would create dangerous opportunities for politicians and bureaucrats to rig the game in favor of special interests while also imposing higher costs of taxpayers and consumers.

Let’s dig into the issue.

In a column for the Wall Street Journal, Mort Kondracke and Matthew Slaughter combine to produce a strong defense of trade.

…the four leading presidential candidates…oppose the U.S. ratifying the Trans-Pacific Partnership. All four demonize trade the same way. …Where is the leader with the courage to tell the truth? To say that trade made this nation great, and that trade barriers will destroy far more jobs than they can ever “save.” …America’s exporters and importers are among the country’s most dynamic companies, paying their workers about 15%-20% more than workers earn elsewhere in the economy. The overall gains are large. Trade and related activities—spurred by accords such as the North American Free Trade Agreement, or Nafta, have boosted annual U.S. income today by about 10 percentage points of GDP relative to what it would have been otherwise. This translates into an aggregate gain of about $1.8 trillion in 2015—thousands of dollars per U.S. household every year. …creative destruction—the movement of people and capital from weaker businesses to stronger ones and new opportunities—is how many of the gains from trade arise. …For generations, American presidents of both parties have spoken about the benefits of trade. “Economic isolation and political leadership are wholly incompatible,” warned John Kennedy. “A creative, competitive America is the answer to a changing world,” said Ronald Reagan. “We should always remember: protectionism is destructionism.”

By the way, I think Kondracke and Slaughter paint with too broad a brush. Both Cruz and Clinton are far less protectionist than Trump and Sanders. Though the authors are correct in noting that they’ve been reluctant (especially in the case of Clinton) to vigorously defend free trade.

The great legal scholar Richard Epstein (also my former debating partner) writesabout the dangers of protectionism.

There are of course major difference between the insidious Trump and buffoonish Sanders. …Still, the real selling point of each boils down to one issue: In the indecorous language of the pollster, Pat Caddell, Americans feel “they have been screwed” by free trade. …free trade is in retreat as protectionism becomes the common thread across the both political parties. It is as though the economic unwisdom of the 1930 Smoot-Hawley Tariff Act is back.

Richard makes a very important point that politicians often support protectionism in an attempt to hide the damage they do with other misguided policies.

Free trade offers an uncompromising indictment of, and a powerful corrective for, America’s unsound economic policies. …the reason that local businesses outsource from the United States is the same reason why foreign businesses are reluctant to expand operations here. Our regulatory and labor environment is hostile to economic growth and there are no signs of that abating anytime soon. …the steady decline in freedom and productivity inside the United States has continued apace. Ironically, the strong likelihood that the next American president will expand protectionist practices will only make matters worse: firms, both foreign and domestic, are more reluctant to invest in the United States…free trade gives the federal government and the individual states strong incentives to clean up their act so that they can once again be attractive to foreign investment.

My buddy Ross Kaminsky explains in the American Spectator that free trade is good because it is part of the competitive process that boosts living standards, particularly for the poor.

…in trade, as in any economic endeavor, there are losers in the short run. Capitalism is, after all, fundamentally a system of creative destruction. But if there is any area of agreement among economists of all political stripes…it is that free trade provides large net benefits to the societies that engage in it, even if other nations do not lower trade barriers to the same degree. Furthermore, the benefits of trade accrue in large measure to the lower economic echelons of society in an extension of Schumpeter’s profound observation that “the capitalist achievement does not typically consist in providing more silk stockings for queens but in bringing them within the reach of factory girls in return for steadily decreasing amounts of effort.”

And Ross echoes Richard Epstein’s point about the real problem being anti-growth policies that make America less competitive.

Trade is complex and like all complex things politicians will dumb it down in a way that benefits them, generally by lying to the public and creating a frothy anger against those “damn furiners” instead of pointing fingers at the true culprits: unions, regulators, and politicians of all stripes.

Ross and Richard are right. If politicians really want more jobs in America, they should be adopting policies to boost U.S. competitiveness.

And we don’t need giant steps. Yes, a flat tax would be great, but even incremental reforms such as a lower corporate tax rate or the right tax treatment of business investment would yield big dividends.

Let’s add a few more voices to the discussion.

In an editorial, the Wall Street Journal debunks Donald Trump’s protectionist tirade against China.

The real-estate developer recently added Japan to his most-wanted list of job killers… “They’re killing us. You know what we sell to Japan? Practically nothing.” Is $116 billion worth of annual goods and services exports to Japan practically nothing? Japan is the fourth largest U.S. export market in goods after Canada, Mexico and China. …The best way to boost American exports is to remove trade barriers with new trade agreements. U.S. farm producers would particularly benefit from the Trans-Pacific Partnership with Japan and 10 other countries. Japanese tariffs on beef would fall to 9% in the 16th year of the deal from 38.5% while the 20% tariff on ground pork would be eliminated in six years. Japan’s 21.3% levy on poultry and eggs would be abolished in six to 13 years.

Writing for the Washington Post, David Ignatius defends trade in general and trade agreements in particular.

…the revolt against free trade that has captured both parties could do the most long-term damage. …there’s strong evidence that trade has benefited the U.S. economy and created whole new industries in which the United States is dominant. That’s the essence of the “creative destruction” that makes a market economy so potent: It relentlessly pushes innovation and change. …The bipartisan protectionism of Trump and Sanders has focused its attacks on the Trans-Pacific Partnership… Robert Z. Lawrence and Tyler Moran estimate that between 2017 and 2026, when TPP would have its major impact, the costs to displaced workers would be 6 percent of the benefits to the economy — or an 18-to-1 benefit-to-cost ratio. …David Autor, David Dorn and Gordon Hanson…noted that the pact would promote trade in knowledge industries where the United States has a big advantage and that “killing the TPP would do little to bring factory work back to America.”

Ignatius also makes a very important observation that protectionists want us to be scared of nations that have much bigger problems than the United States.

Trump, the businessman, seems weirdly out of touch with real economic trends. He speaks of Japan as though it were an economic powerhouse, when it has actually suffered a two-decades-long slump; he describes a surging China, when the numbers show its growth is sagging.

Amen. Japan has huge problems and China still has quite a way to go before it becomes a developed nation.

Let’s close with some good news. Politicians may be engaging in anti-trade demagoguery, and there may be some voters that are motivated by hostility to voluntary exchange, but that doesn’t mean the protectionists have won.

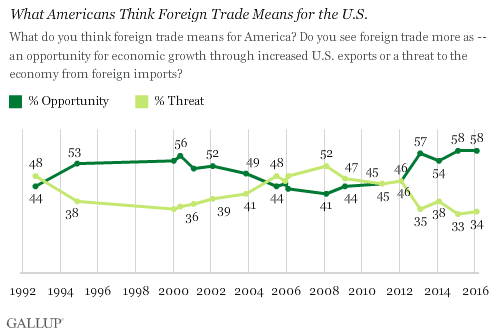

Indeed, pro-trade sentiment has never been higher by some measures. Here’s some amazingly positive polling data from Gallup.

P.S. One final point. The growing burden of government spending and taxation since World War II have been very unfortunate, but the good news is that we have strong evidence that the economic damage of worsening fiscal policy has been offset by the economic gains from trade liberalization. It would be tragic to see that reversed.

P.P.S. Fans of Richard Epstein may enjoy this video of him reminiscing about Barack Obama’s undistinguished tenure at the University of Chicago Law School, as well as this video of him dismantling George Soros in a debate that took place at Cato.