Businessmen in the Santa hat with big red sack of presents in the City looking through the binocular. Christmas in business, concept illustration. (Photo: AdobeStock)

Equity Markets are poised to start the week where they closed out the month of November, on a sharp trajectory higher that could have us testing critical resistance levels during the first few hours of trading.

Clearly, the catalyst for a strong rally across the globe is the thawing of a stalemate on trade talks between the U.S. and China, following a working dinner Saturday evening between their respective trade delegations including President Trump and Chinese President Xi Jinping at the G20 summit in Buenos Aires.

While nothing definitive was agreed to, and admittedly both sides are featuring different points of emphasis, market expectations had been so meager toward any progress that investors are enthusiastically cheering the breakthrough, with gains of nearly +2% in early trading in stock index futures.

The market reaction in China was decidedly positive as stock markets in China and Hong Kong closed out the day with gains ranging from +2.5% to +2.8%.

While a 90 day reprieve leaves much work to be done on both sides, investors are viewing this as much better than the alternative of tariffs being increased from 10% to 25% on over $200 billion of Chinese goods in early 2019.

That being said, if investors sense minimal progress on resolving the difficult issues including Intellectual property rights, and other non-tariff barriers, the enthusiasm could wane quickly as we head into the new year.

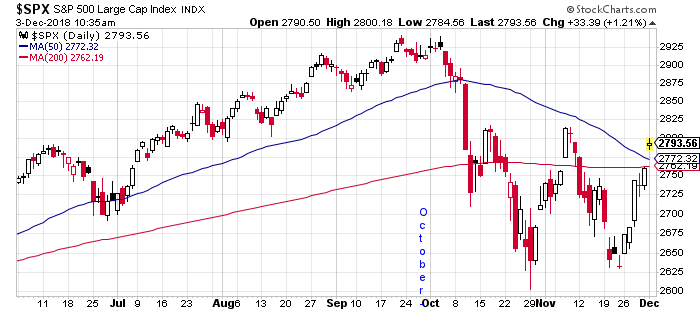

If today’s early morning rally holds, the market will be pressing right against the S&P 500; 2810 – 2815 level that proved to be stubborn resistance in both mid October and early November. On both occasions stocks hit that level like a brick wall before turning sharply lower, retreating over 5% within 2 weeks on each occasion.

After stocks put in an almost textbook double bottom, just over 3 weeks apart from October 29 to November 23, my feeling is, we’ll know within a day or two if the 2810 – 2815 level is stubborn resistance for the third time, or if the Santa Claus rally carries through, and into the big gap from the early October sell off.

If the S&P 500 (^SPX) can close above the 2810 – 2815 resistance level with any conviction, it would set the stage for a move higher into year end.

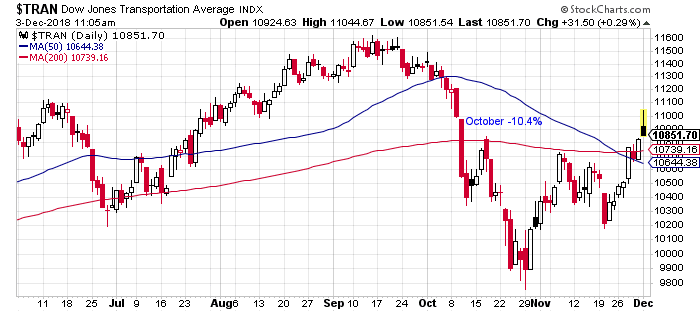

The DJ Transportation Average notably outperformed during November. After over a 10% decline in October, the “death cross” where the 50 day moving average trended below the 200 day MA during the 3rd week of November has so far turned out to be a contra indicator.

The DJTA is poised to close at its highest level since the first week of October, and above both moving averages for the 3rd time in the last 4 days. If the DJ Transports can hold above the 10,800 level it would be very technically positive toward building a base above the reaction highs from mid October and early November.

A couple hours into trading, stocks have given up half their gains from shortly after the opening 30 minutes of trading, but are holding onto gains of 0.75% to 1.0 %. Breadth is still healthy, with advancing issues leading decliners by better than 2 to 1. Retailers and Utilities are 2 of the weaker sectors, with the banks also slightly underperforming.

While some pull back off a sharply higher opening is not alarming, we would certainly view it negatively it the broad market reversed to the downside during the afternoon. Best guess is that is unlikely given the move in global markets overnight, and the market breadth holding predominately green.

Stocks should gain support from the ISM Manufacturing Index (PMI) released this morning, which came in at 59.3, beating consensus of 57.2 and ahead of the October reading of 57.7.

In an environment where there is daily if not hourly chatter over concern of a slowing economy, That’s an Impressive Report.

Stay tuned.