The White House at 1600 Pennsylvania Ave., left, and the Internal Revenue Service (IRS) headquarters in D.C., right.

Over the years, I’ve run into oddball stories about what happens when politicians and bureaucrats get involved with matters relating to sex.

- California bureaucrats are regulating participants in porn films, as humorously described by Mark Steyn.

- The World Bank is paying poor young women so they don’t take up with sugar daddies.

Obamacare is so costly that some young women are looking for sugar daddies.

Obamacare is so costly that some young women are looking for sugar daddies.- Obamacare also subsidizes Viagrafor sex offenders.

- British taxpayers are financing sex trips to Amsterdam.

- The U.S. Tax Court has ruled that money spent on sex change operations is deductible.

- The law in Hawaii allows cops to have sex with prostitutes.

- In Germany, by contrast, prostitutes have to use parking meters to pay tax.

- A brothel in Austria offered free sex to customers to protest high taxes.

- Pakistani officials use transsexuals to encourage tax payments.

- But in Colorado, you can get busted (no pun intended) for cutting hair while topless, but not because you’re bare-chested.

- Topless dancing isn’t artistic and therefore is subject to sales taxaccording to a New York judge.

- The United Nations wants taxpayer-financed birth control to be a human right.

- And in Spain, porn has a lower tax rate than the theatre.

And here are two more examples. Government isn’t involved yet, but will be if statists get their way.

- Leftists concocted a crazy theory that tax havens promote sex slavery.

- And other leftists hypothesized that climate change promotes prostitution and AIDS.

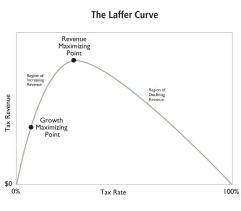

Let’s add to our collection. We now have new evidence in favor of the Laffer Curve, thanks to Illinois politicians levying a tax on strip clubs.

Here are some excerpts from a story in the St. Louis Post-Dispatch.

…she and others…were expecting at least $1 million to be raised…the Live Adult Entertainment Facility Surcharge tax…went into effect Jan. 1, 2013, with the first monies collected in fiscal year 2014. For that fiscal year, the State Department of Revenue reported $405,996.62 in revenue; over the next two fiscal years, the amounts collected were a bit more — $501,334.85 for fiscal year 2015 and $532,271.46 for fiscal year 2016. The state’s newest ‘sin tax,’ which poses a tax on facilities that serve alcohol and that have live adult entertainment, includes topless, nude dancing and stripping. “They were expecting it to raise quite a bit of revenue,” McClanahan said of the tax on strip-club type facilities… “We anticipated it would be a greater number of clubs that would be paying and we would have anticipated about a million in revenue,” Poskin said. “So I don’t know if that if the tax that they’re paying is accurate and consistent with their gross receipts.”

The bottom line (no pun intended) is that politicians collected about half as much money as originally projected. It’s unclear, to be sure, why the revenues didn’t materialize.

The clubs are probably engaging in a bit of avoidance and evasion, which is quite common in all areas of the economy when tax burdens increase.

The clubs are probably engaging in a bit of avoidance and evasion, which is quite common in all areas of the economy when tax burdens increase.

And the clubs presumably are suffering from a loss of business because of the tax, which also is a common effect of higher tax burdens in all sectors of the economy.

Which gives me an excuse to make a broader point about the economy-wide implication of higher tax burdens.

Scott Sumner compares output in the U.S. and the four biggest European nations (Germany, U.K., France, and Italy), observes that per-capita tax collections in the U.S. are almost as high as they are in these other countries with far higher tax burdens, and has some must-read analysis about the very high economic cost of getting additional tax revenue.

…tax rates in the US are about 31% lower than in Europe, so there is a lot of scope for tax increases in the US. But how much revenue would those higher taxes actually collect—in the long run?

This data suggests not very much. …we are in a region where disincentive effects are kicking in. GDP per person in these four countries is about 25.5% lower than in the US (PPP), so they only raise about 7.5% more revenue that we do, despite far higher tax rates. …The mistake that progressives make is to see the huge US GDP as a sort of piggy bank from which money can be raised for any policy objectives, without killing the goose that lays the golden eggs. …it’s clear that progressivism can never succeed in America. The only question is how badly it will fail.

Looking at all this data, the one important question that must be asked is how anyone could possibly think that it’s a good idea to sacrifice 25.5 percent of our income in order to give politicians 7.5 percent more tax revenue.

By the way, for those who think Scott’s conclusions are somehow illegitimate because they’re based on back-of-the-envelope calculations,  check out the very detailed and rigorous analysis from the European Central Bank that found an even larger negative relationship between tax revenue and foregone economic output.

check out the very detailed and rigorous analysis from the European Central Bank that found an even larger negative relationship between tax revenue and foregone economic output.

In other words, there is a Laffer Curve. When tax burdens climb, taxable income falls. Which is just another way of stating that the cost of higher taxes isn’t just that politicians take our money. They also impose lots of damage on the economy, which means we suffer from lower earnings.

So it’s a double-whammy. They tax more, we earn less.

P.S. While I don’t want politicians involved with sex, I must confess that there’s also some compelling evidence that people don’t want economists involved with sex.