Workers in protective equipment are reflected in the window of a betting shop with a display inviting customers to place bets on tbe result of the general election with images of Britain’s Prime Minister Theresa May and opposition Labour Party leader Jeremy Corbyn, in London, June 7, 2017. (Photo: Reuters)

I wrote yesterday about a very depressing development in the United Kingdom. Politicians in that country – including some supposed fiscal conservatives – are contemplating a big expansion in the burden of government spending in order to give pay hikes to the bureaucracy.

What makes this so unfortunate is that the country has been making fiscal progress. Ever since 2010, government spending has grown by an average of 1.6 percent annually. And since the private economy has expanded at a faster pace, this period of restraint has satisfied my golden rule. In other words, the public sector – though still very large – is now a smaller burden on the private sector.

What makes this so unfortunate is that the country has been making fiscal progress. Ever since 2010, government spending has grown by an average of 1.6 percent annually. And since the private economy has expanded at a faster pace, this period of restraint has satisfied my golden rule. In other words, the public sector – though still very large – is now a smaller burden on the private sector.

This progress could be quickly reversed, though, with a new spending binge. And it would be especially foolish to throw in the towel just to give more money to government employees. Just like in the U.S., bureaucrats already are overcompensated compared to their counterparts in the productive sector of the economy.

Let’s take a closer look at whether U.K. policymakers should end “austerity” and expand the relative burden of government spending.

The Centre for Policy Studies in London has examined the issue, and this new research from CPS debunks the notion that there should be large increases in bureaucrat compensation.

But since we covered that topic yesterday, let’s focus instead on what CPS discovered when reviewing the impact of spending restraint on various economic aggregates.

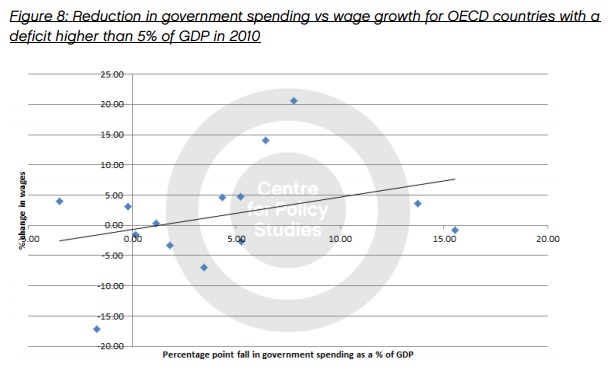

…when examining OECD countries that were left with a large budget deficit in 2010 (those countries with a deficit of over 5% of GDP in 2010), it appears that there is a strong correlation

between those countries that cut spending by a higher degree, on average, and countries which achieved a larger reduction in deficit, higher average growth rates, a larger fall in proportionate unemployment and marginally better wage growth (see Figures 5, 6, 7 and 8). Of course, correlation does not necessarily mean causation. However, this provides strong evidence that there is no link between austerity and lower growth, higher unemployment and weaker wage growth.

Let’s look at the charts referenced in the excerpt.

We’ll start with Figure 5, which looks at relationship between spending restraint and deficit reduction. Nobody should be surprised to see that the symptom of red ink shrinks when there’s a reduction in the underlying disease of too much government spending.

I think the most important data is contained in Figure 6, which maps the relationship between economic growth and spending restraint. As you can see, a lower burden of government spending is associated with better economic performance.

There’s also a connection between smaller government and lower joblessness, as shown in Figure 7.

Last but not least, Figure 8 shows the positive relationship between lower spending and higher wages.

As explained in the CPS report, correlation is not causation. But since these results are in sync with research from academic scholars (and even research from left-leaning bureaucracies such as the IMF, World Bank, and OECD), the only prudent conclusion is that the U.K. should not give up on fiscal responsibility.

And perhaps the real lesson is that a constitutional spending cap should be enacted whenever a consensus for good policy materializes. That way, there’s a much lower risk of backsliding when politicians get weak-kneed.