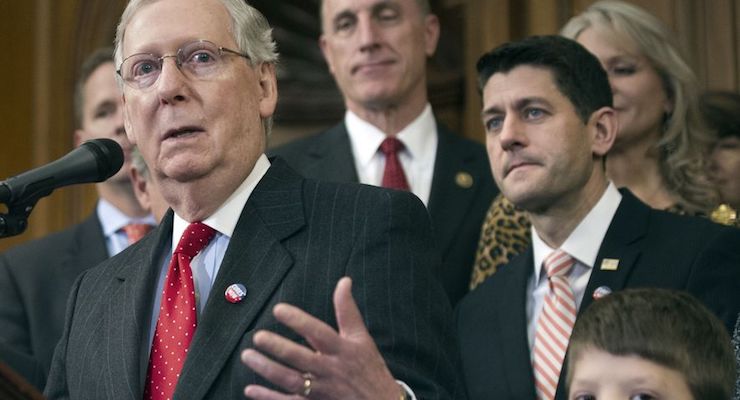

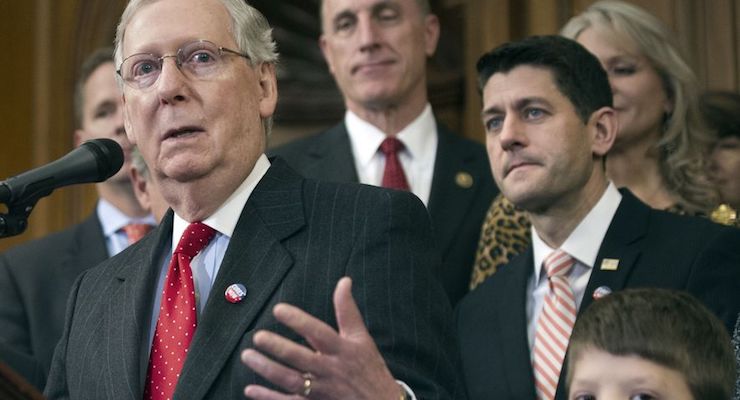

House Speaker Paul Ryan of Wisconsin and others listen as Senate Majority Leader Mitch McConnell of Kentucky speaks on Capitol Hill in Washington on Dec. 8, 2016.

House Republicans, as part of a generally laudable tax reform plan, want to replace the corporate income tax with a “destination-based cash-flow tax.”

I’ve addressed that topic a couple of times.

- Left-leaning advocates like “destination-based” tax systems such as the DBCFT because such systems undermine tax competition and give politicians more ability to increase tax rates.

- The “border adjustability” in the plan is contrary to the rules of the World Trade Organization (WTO) and there’s a significant risk that politicians might try to “fix” the plan by turning it into a value-added tax.

- In theory, the import tax in the DBCFT is not necessarily protectionist, but the machinations of to justify that assertion, combined with the conflict it creates in the business community, undermine the consensus for reform.

I had a chance to speak about the DBCFT to a gathering put on by the Washington International Trade Association. I hit on all my main reasons for being worried about the border adjustable provisions.

For those who want additional information, I was preceded on the panel by Gordon Gray of the American Action Forum and followed by John Veroneau of Covington and Burling (and formerly with the Office of U.S. Trade Representative). You can watch the entire event by clicking here.

Regarding my remarks, I think the most relevant thing I said was when I shared new data from the Congressional Budget Office and pointed out that we can simultaneously balance the budget within 10 years and have a $3 trillion tax cut if politicians simply exercise a modest bit of spending restraint and limit annual budget increases to 1.96 per year.

And the most important thing that I said was when I warned that proponents of good policy should never do anything that might create the conditions for a value-added tax in the United States. Some people say the most important rule to remember is to never feed gremlins after midnight, but I think it’s even more important not to give politicians a new source of revenue.

Unless, of course, you want bigger government and more red ink.

[social-media-buttons]