Mario Draghi, President of the European Central Bank speaks during a press conference. (Photo: REUTERS)

It’s relatively easy to demonstrate how certain regulations make our lives less pleasant (inferior light bulbs, substandard toilets, inadequate washing machines, crummy dishwashers, etc).

Furthermore, it’s also simple to highlight examples of foolish and preposterous regulations.

And it’s a straightforward exercise (at least conceptually) to argue that regulations should pass some sort of cost-benefit test.

What’s not so easy, however, is getting folks to grasp the overall impact of red tape on growth and living standards. After all, most normal people don’t want to learn about wonky concepts such as the production possibilities frontier. And I also doubt there are many people who are interested in the technical challenge of how to measure the aggregate impact of thousand of rules and restrictions.

But these issues matter. A lot. According to Economic Freedom or the World, the regulatory burden is just as important as the fiscal burden when determining a nation’s competitiveness and economic outlook. Simply stated, our living standards are determined by productivity, which is determined by how wisely labor and capital are combined to generate output.

With this in mind, a new study from the European Central Bank helpfully examines the degree to which regulation hinders the efficient allocation of those factors of production.

The focus of this paper is on the…misallocation of labour and capital in eight macro-sectors (which include manufacturing and services) for five large euro-area countries (Belgium, France, Germany, Italy and Spain) during the period 2002-2012. …The paper then investigates the potential determinants of changes in input misallocation by looking at traditional structural determinants, namely restrictive product and labour market regulations. …regulations that shelter firms from competition might result in poor allocation of resources because low productive firms will keep operating instead of downsizing or exiting. Similarly, stringent labour market regulation, in the form of high hiring and firing costs, might also thwart resource allocation.

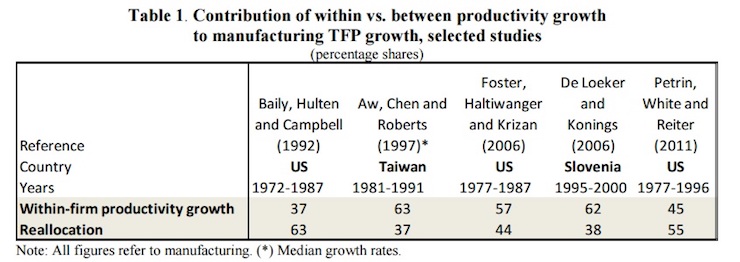

For those who are interested in such things, the study looks at what drives improvements in productivity. Is it firms becoming more efficient because of competition, or is “reallocation” as weak companies vanish and dynamic new firms emerge?

The short answer, as illustrated by the table, is that both play a role.

Here are some of the issues considered in the ECB study.

In our full empirical specification, as well as initial conditions in misallocation, …we first examine the role of two structural factors, i.e. changes in both product and labour market regulations. In the presence of high barriers to entry, unproductive firms are able to survive and therefore retain productive resources which are not shifted to the most efficient firms in a given industry (Schiantarelli 2008; Restuccia and Rogerson 2013; Andrews and Cingano 2014). Furthermore, more stringent employment regulation might prevent firms from adjusting their workforce to optimal levels, therefore hampering the efficient reallocation of workers across firms (Haltiwanger, Scarpetta and Schweizer 2014; Bartelsman, Gautier and de Wind 2011). Moreover, in the labour misallocation regressions we also include an interaction term between the changes in product and labour market regulations.

Here are their estimates of both product market regulation and labor market regulation for selected nations.

It’s good to see that there’s a slight trend toward less regulation of product markets. A few nations have modestly reduced regulation of labor markets, but the most interesting observation is that this is an area where the United States has a major advantage. Only Germany is even close to America in allowing markets to operate with a high level of freedom.

Having examined the issues covered by the study, let’s now consider the results.

All discussed capital misallocation results are robust to the inclusion of market distortions, i.e. to regulatory and credit constraints. …The general decline in PMR over the period considered dampened capital misallocation dynamics… Stricter product market regulation is found to have led to higher labour misallocation growth. But we also find that more stringent labour market regulations positively correlate with labour misallocation growth, particularly in sectors characterized by more stringent product market regulations. Thus, these results support the idea that the positive effect of the tightness of PMR on labour misallocation growth is amplified if also EPL becomes more restrictive. Seen from an inverse perspective, the gains in the allocative efficiency of labour are larger if both kinds of regulation are jointly loosened.

Here’s the bottom line.

Our results therefore suggest that in order to foster a more efficient within-sector allocation of inputs across firms structural reforms, such as those lowering entry barriers for firms, removing size-contingent regulations that prevent firms from reaching their optimal size and enhancing bankruptcy regulations that facilitate the exit of unproductive firms, would be warranted. The loosening of PMR and EPL in recent years in some countries has proven to dampen misallocation dynamics, yet there is still room for further reductions, as shown for example when comparing the level of regulation with that in the U.S.

Unfortunately, I don’t expect that this study will have any sort of impact on the debate. The people who already understand the negative impact of regulation now have more evidence about the value of unfettered markets and creative destruction.

But the politicians and interest groups won’t care. They are interested in accumulating power and obtaining unearned benefits. To the extent that they would even bother to read the study, they would conclude that they should fight extra hard to preserve the status quo since they will realize that there are fewer favors to distribute when genuine capitalism is allowed to operate.