Mitch McConnell and Paul Ryan attend a bust unveiling ceremony for former Vice President Dick Cheney in the Capitol Visitor Center’s Emancipation Hall, Dec. 3, 2015. (Photo: Tom Williams/CQ Roll Call/AP)

Led by Speaker Paul Ryan, House Republicans have put forth an anti-poverty agenda. It’s definitely worth reading just for the indictment of the current welfare state. There are some excellent charts, including versions of ones that I’ve already shared on the $1 trillion-plus fiscal burden of current welfare programs, as well as the “bloated, jumbled, and overlapping bureaucracy” that administers all that money.

But there are some charts that deserve to be reproduced, either because they contain new insights or because they make very important economic points.

Regarding the former, here’s a chart that indirectly shows that the most effective anti-poverty program is work. Specifically a full-time job.

So the real challenge is why there are some households with persistent multi-generational poverty.

And, as Thomas Sowell already has told us, that’s a behavioral problem.

But it’s somewhat understandable behavior because government in many cases makes dependency more attractive than self-sufficiency.

Here’s a chart showing the implicit marginal tax rates that apply if a poor household tries to climb out of poverty. The bottom line is that handouts are so generous that it’s very difficult for a poor person to be better off by working instead of mooching.

No wonder dependency is a growing problem!

Some folks say the solution to this problem is to reduce the “phase-out” of benefits, but that’s a recipe for making the welfare state vastly more expensive and giving handouts to people who are not poor. That’s the approach in some European nations and it hasn’t worked.

Here’s another chart that basically makes the same point about the upside-down incentive structure created by redistribution programs. It shows that a poor household can enjoy a much higher standard of living with low earnings than with high earnings.

And this video is an excellent introduction to that topic.

But let’s focus on the GOP anti-poverty plan. They put together a powerful indictment of what we have now, but what are they proposing as a solution?

Here’s where we get good news and bad news. The good news is that there is a focus on work, as explained in a column for Forbes by Scott Winship of the Manhattan Institute.

…the report declares that “Our welfare system should encourage work-capable welfare recipients to work or prepare for work in exchange for benefits, and states should be held accountable for helping welfare recipients find jobs and stay employed.” The blueprint points toward greater use of work requirements and time limits for food stamp recipients and beneficiaries of federal housing benefits who are able to work. …This emphasis on work generalizes the experience from the landmark 1996 welfare reform legislation, which increased work among single-parent families, reduced welfare receipt and (most importantly) lowered poverty.

So far so good, and Scott also notes that the key to work is reducing the appeal of being on the dole.

Most of the success of welfare reform in encouraging work can be attributed to the ways that it has made receipt of benefits less attractive relative to work. People largely left welfare or chose not to enroll independently of state work promotion efforts.

But here’s the problem. There’s no big attempt to reduce benefits in the GOP proposal.

Indeed, it doesn’t even turn programs over to the states, which presumably would lead to better policy since sub-national governments wouldn’t want to be overly generous lest they attract welfare migration.

But the dog that didn’t bark in the new agenda is the consolidation and block granting proposed in Speaker Ryan’s Budget Committee discussion draft from 2014. Rather, the blueprint appears to envision increased use of state waivers in the various programs… It is worth recalling that in the 2014 discussion draft, the “opportunity grants” that would have combined a dozen federal programs and funded them at a fixed level were proposed as a pilot program in a few states.

Though at least the plan apparently doesn’t increase the fiscal burden of the welfare state by further expanding the EITC, which already is the federal government’s most costly redistribution program.

The antipoverty blueprint mentions the Earned Income Tax Credit (EITC)…only in passing. On the one hand, the report points out that an expanded EITC would be one way to reduce some of the high marginal tax rates that recipients of federal aid face when they contemplate working. On the other, the program’s high rate of improper payments is also emphasized, rightfully, as a problem that must be addressed.

Scott also points out that the Republican plan also foresees a much more aggressive attempt to measure what works and doesn’t work. Which is good, though hardly necessary since we already know that a one-size-fits-all approach from Washington is a recipe for ever-higher costs and ever-increasing dependency.

Indeed, there’s even a Laffer Curve-type relationship between welfare spending and poverty.

Let’s check out a couple of other reactions.

From the left, Jordan Weissman of Slate is predictably unimpressed.

As part of his effort to convince Americans that the Republican Party is [not] a band of nihilistic anti-government lunatics—House Speaker Paul Ryan unveiled…an anti-poverty plan. Which is a laugh riot. …Most of the agenda is a rehash of, or at least a variation on, material Ryan has trotted out before. Inspired by the welfare reforms of the 1990s, the speaker still wants to push more safety net beneficiaries to go to work, devolve more program control down to state and local officials, and yet somehow increase accountability and carefully monitor results… There’s also some talk about increasing the Earned Income Tax Credit for low-wage workers—which is one of those nice, liberal-conservative consensus positions that never seems to go anywhere.

From the right, Kevin Williamson sympathizes with the GOP/Ryan approach, but also makes a more important point in his National Review column.

Paul Ryan has just introduced a welfare-reform proposal… We already knew what was going to be in it — work requirements and time limits for able-bodied adults — because there are only so many meaningful avenues of reform. We also know what the Left’s response is going to be: that this is cruel, callous, punitive, etc. But there are really only two choices: Get people moving toward economic self-sufficiency or sustain them forever in the soul-killing state of dependency. There isn’t a third option. Not really. This is only partly about money. We are a very, very rich society, and we can afford to provide decently for people who cannot care for themselves, including children and those who are physically or mentally disabled. But that isn’t our problem: Our problem isn’t people who are physically disabled but people who are morally disabled, people who wouldn’t take a bus 15 minutes to work at a gas station, much less walk 15 miles to do so.

My view, for what it’s worth, is that the only good welfare reform is one that shifts all programs to the states as part of a block grant. But since funding redistribution is not a function of the federal government, that block grant should then disappear over time.

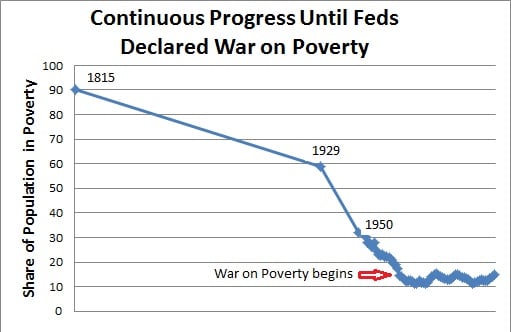

Last but not least, we need to understand that economic growth is easily the most powerful and effective anti-poverty program. That’s why the poverty rate fell from 90 percent to 15 percent in America before we had a welfare state.

And it’s no coincidence that we stopped making progress once the so-called War on Poverty began.