In this June 25, 2015 file photo Greek Prime Minister Alexis Tsipras, left, and Italian Prime Minister Matteo Renzi speak with German Chancellor Angela Merkel during a round table meeting at an EU summit in Brussels. Merkel has been named Times’ Person of the Year, praised by the magazine for her leadership on everything from Syrian refugees to the Greek debt crisis. (Photo: AP, File)

Even though it has the largest economy in Europe, I routinely ignore Germany. This isn’t because of deliberate malice or neglect, but rather because the country has boring economic policy.

Unlike Estonia and Switzerland, it doesn’t have any really good policies that are worth applauding.

Not does it have really bad policies that deserve to be mocked, so it doesn’t get the negative attention that I shower upon nations such as France, Italy, and Greece.

Heck, about the only really interesting thing about German policy is whether the country’s politicians will be dumb enough to underwrite the profligacy of some of their neighbors.

Heck, about the only really interesting thing about German policy is whether the country’s politicians will be dumb enough to underwrite the profligacy of some of their neighbors.

Let’s try to atone for this oversight by giving some attention to the peculiar German tendency to be a bit over-zealous about generating money for the government.

- The Germans, after all, came up with an odd scheme to make streetwalkers pay a nightly tax via parking meters.

- The Germans also imposed a tax on online coffee beans that cost €30 to enforce for every €1 collected.

- The Germans even fined a one-armed bicyclist because he didn’t have handbrakes on both handlebars.

We have another example of über-intense tax enforcement to add to our list.

The BBC reports that homeowners on a German street are having to pay for a road that was built by the Nazis.

Homeowners on a street in Germany have been told they must foot the bill for their road’s construction – even though it’s been there for nearly 80 years. …

The bills included a conversion from the Nazi-era Reichsmark currency into euros for the original road surface, first laid in 1937… The figures were also adjusted for inflation. …a court has now confirmed that they must cough up the cash. It determined that while construction began in the 1930s, the road was only officially completed in 2009 when pavements were added. For the intervening period it was considered to be under development. …Auf’m Rott’s current residents will be shelling out for the “Hitler asphalt”, streetlamps dating back to 1956, a sewer from the 1970s, and pavements and greenery added in 2009.

How stereotypically German. Not only is there an unusual tax, but they even have the records from the 1930s and went though  all the trouble of adjusting the numbers for inflation.

all the trouble of adjusting the numbers for inflation.

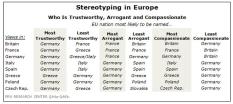

Wow, no wonder other Europeans think the Germans aren’t very compassionate.

By the way, I suspect the German homeowners also think their country isn’t very considerate. The homeowners aren’t getting hit with some annoying-yet-trivial €100 euro charge.They really are “shelling out.”

…city authorities told them pay an average of 10,000 euros ($11,000; £8,400) per household

I guess I’m lucky that Fairfax County in Virginia, which just re-paved my local street, didn’t send me a similar bill!

Though in the interest of fairness, let’s contemplate the German system, which apparently is vaguely based on a user-pays principle.

In Germany, residents have to pay a “development contribution” to the local authority for things like new roads, cycle paths and street lighting.

Part of me actually likes this approach. It’s better to have local communities pay for local infrastructure rather than having some convoluted and wasteful nationwide program (like we have to some degree in the United States) that is susceptible to waste and cronyism.

On the other hand, surely there must be something wrong with doing some routine maintenance on a street and then using that as an excuse to send homeowners a giant bill for expenses that mostly occurred during the Hitler era.

P.S. I haven’t totally ignored Germany. Over the years, I’ve bemoaned the fact that the ostensibly conservative Christian Democrats aren’t conservative and complained that the supposedly classical liberal Free Democrats aren’t classical liberals.

P.P.S. Though I’ve also given the Germans some modest praise for a period of spending restraint last decade and also for largely resisting the siren song of Keynesianism during and after the recent recession (by the way, you won’t be surprised to learn Krugman botched the numbers when writing about Germany’s fiscal policy during that period).

P.P.S. Though I’ve also given the Germans some modest praise for a period of spending restraint last decade and also for largely resisting the siren song of Keynesianism during and after the recent recession (by the way, you won’t be surprised to learn Krugman botched the numbers when writing about Germany’s fiscal policy during that period).

P.P.P.S. And I have pointed out that the German government occasionally can waste money with Gallic flair. Or even display Greek levels of government incompetence. So, unlike the Washington Post, I would never refer to the country as being “fiscally conservative.”

P.P.P.P.S. By the way, it’s not just the German politicians who are in love with the idea of taxation. There are even some German taxpayers who protest because they want to be saddled with higher tax burdens (though I wonder if they’d be as hypocritical as their American counterparts if they faced a put-up-of-shut-up challenge).