Sign on the Internal Revenue Service (IRS) building, Internal Revenue Service HQ, Washington, D.C.

Republicans promised voters all sorts of pro-growth reforms. They assured us that they learned a lesson about the dangers of expanding government and calling it “compassionate conservatism.”

Give us control of both Congress and the White House, they said before the election, and we’ll move our agenda to limit government and drain the swamp in Washington.

- Repeal ObamaCare!

- Cut tax rates!

- Slash wasteful spending!

- Reform entitlements!

- Eliminate senseless red tape!

Of course, now that they’re in power, they’re getting cold feet. It now appears there will be reform of the disastrous ObamaCare law, but not full repeal. Moreover, tax cuts are being jeopardized by a risky scheme for a $1 trillion “border-adjustable” tax hike. Based on Trump’s recent address to Congress, I’m also not holding my breath for much-needed spending cuts and entitlement reform. And it’s unclear whether we’ll see much progress cutting back on the mountains of regulation hindering economic vitality.

Even the easy promises may not be fulfilled.

The Foreign Account Tax Compliance Act (FATCA) is an odious law enacted back in 2010 when the left controlled all the levers of power. It’s horrible legislation that threatens the rest of the world with financial protectionism (a 30 percent levy on all money flowing out of the United States) unless foreign governments and foreign financial institutions agree to serve as deputy tax collectors for America’s anti-competitive worldwide tax system.

That’s the bad news.

The good news is that the Republican platform endorses the repeal of this onerous law.

But will GOPers deliver on that promise? Especially if the left unleashes the kind of demagoguery we often see in Congress and that we saw from Obama during the 2008 campaign?

I guess time will tell, but if the goal is good policy (and keeping promises), this law deserves to be tossed in the trash.

I’ve previously explained that FATCA is so brutal that it has led many overseas Americans to give up their citizenship simply because FATCA made their lives miserable. They couldn’t open bank accounts. They had trouble finding places to manage their investments. Even retirement accounts became a nightmare.

Some people said that these difficulties were just temporary and would disappear once everyone learned how the law operated.

Hardly. Let’s start with some data from a Bloomberg story that should be a wake-up call for the crowd in Washington.

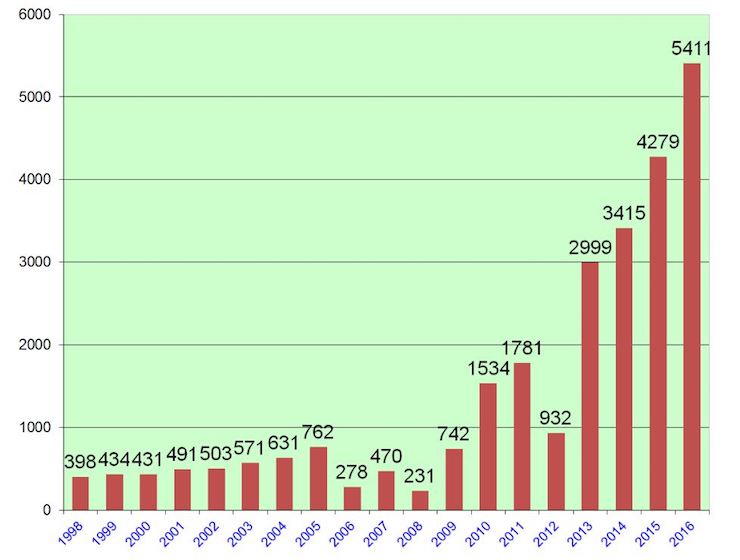

The number of Americans renouncing their citizenship rose to a new record of 5,411 last year, up 26 percent from 2015, according to the latest government data. …Since Fatca came into being, annual totals for Americans renouncing citizenship have reached their four highest historic levels.

And here’s a chart showing this dismal trend.

The number of Americans renouncing their citizenship in the U.S. from 1998 to 2016.

The Wall Street Journal opines on this issue today.

…the Foreign Account Tax Compliance Act (Fatca) became law in 2010 to go after fat cats stashing money abroad, these pages have reported that it has led the IRS to treat law-abiding Americans as criminals. …Under Fatca, Americans must now report overseas holdings of more than $50,000 even if they owe no taxes, or else face crushing fines. For foreign financial institutions, the penalty for not giving the IRS what it wants to know about their American clients is a 30% withholding penalty on any U.S.-sourced payment to these institutions. …With the GOP controlling Congress and White House, the time is ripe for Republicans to make good on their pledge and give Fatca the heave-ho.

Amazingly, even the “taxpayer advocate” at the IRS recognizes the law is a disgrace, reversing the presumption of innocence in the Constitution.

The IRS has adopted an enforcement-oriented regime with respect to international taxpayers. Its operative assumption appears to be that all such taxpayers should be suspected of fraudulent activity, unless proven otherwise.

This is a remarkable development. I’ve groused before that the IRS’s taxpayer advocate has a bad habit of advocating for the IRS rather than the American people, so FATCA must be really bad to generate a report that actually defends the rights of taxpayers.

It’s also bad news for financial institutions.

An article in the Economist has some very remarkable admissions, including the fact that compliance costs will be at least twice as high as the tax revenue that ostensibly is being generated.

FATCA’s intrusiveness has caused concern among banks and fund managers. It raises big questions about data privacy. Compliance costs, mostly borne overseas, are likely to be at least double the revenue that the law will generate for America. The necessary overhauls of systems and procedures and the extra digging around to identify American clients could add $100m or more to a large bank’s administrative costs. No wonder bankers have dubbed FATCA the Fear And Total Confusion Act. An OECD tax official describes the law as “awful, in a way, like a nuclear bomb” but also sees it as “a remarkable leap forward for transparency”. …A further concern is the risk of misuse of information by corrupt administrations, or rogue government employees, such as the sale of personal financial data to would-be kidnappers.

It’s also revealing that an OECD bureaucrat thinks that an “awful…nuclear bomb” can be seen as a “remarkable leap forward.” I guess that’s the attitude we should expect from leftist bureaucrats who are exempt from paying tax on their own bloated salaries.

But I call it disgusting and I desperately hope that Trump gets rid of the subsidies that American taxpayers send to this parasitical Paris-based bureaucracy.

But I’m digressing.

Let’s now focus on how the law is an attack on the sovereignty of other nations (and how it creates a precedent that will be used to attack America’s fiscal sovereignty).

Some leftists justify this wretched law by saying it only targets so-called tax havens. But Trinidad and Tobago is hardly in that category. Yet because FATCA applies to the entire world, a senior official in that country very much hopes Trump will follow through on promises in the Republican platform to repeal the misguided legislation.

Kamla Persad-Bissessar, the leader of the opposition coalition in parliament, recently…discovered that the GOP had called for repeal of the Foreign Account Tax Compliance Act, or Fatca, which is best understood as a license for IRS imperialism. …Mrs. Persad-Bissessar wrote Donald Trump in January asking if he will keep this promise. …Mrs. Persad-Bissessar, a former prime minister, wants to know because the Trinidad and Tobago parliament is now considering changing the nation’s laws to accommodate Fatca.

Repeal would be good for T&T, but it also would be good for the USA.

Americans have an even bigger stake in the answer. …the law has become another example of gross federal overreach, adding another burden on Americans overseas who are already paying taxes where they live. The 2010 law has almost no parallel anywhere, for good reason. While most nations limit their taxes to income earned within their borders, the U.S. is among the smaller group of nations that taxes its citizens on global income. …The roughly eight million Americans working overseas have been hit hardest by this bad law. Some foreign banks and financial institutions have responded simply by refusing to take American customers, on grounds that Fatca requirements are more trouble than the business is worth. For similar reasons others do not want Americans as business partners. Many others of modest means who owe no U.S. taxes can still find themselves hit by hefty fines and penalties because they have fallen afoul of the reporting requirements.

Heck, even if the law isn’t repealed, Trump can defang it.

…the whole Fatca edifice has been built on the intergovernmental agreements that Treasury has negotiated with more than 100 countries—agreements for which there is no statutory authority or Congressional ratification. Mr. Trump could take the teeth out of Fatca by announcing he has suspended negotiations for future agreements and won’t enforce the ones we have. …Let’s hope President Trump gives the answer that Americans deserve, by making clear he intends to deliver on the GOP pledge to dismantle a bad law that never should have been passed.

Amen.

The law is also running into problems in Israel, another nation that hardly fits the “tax haven” definition. A Forbes columnist has a dismal assessment of this intrusive and destructive law.

…the Israeli High Court’s temporary injunction against the enforcement of America’s controversial global tax law FATCA should serve as “a wake-up call” for other nations to rethink enforcing this “toxic, flawed and imperialistic legislation,” according to the boss of a leading independent financial firm that advises high-net-worth individuals (HNWI’s) and expats globally. …“Justice Meltzer’s action should be championed,” deVere’s Green asserts, who is an outspoken critic of FATCA. “His wise caution should serve as a wake-up call for other countries to rethink enforcing this toxic, flawed, damaging legislation that is being imposed on sovereign states around the world by the U.S.” …FATCA could indeed be described as a “masterclass” in fiscal imperialism and unintended consequences. But also of concern is that the US is increasingly secret in matters of financial data. It’s no wonder some have labelled it “horrific” and a nightmare for financial institutions. …Perhaps unsurprisingly there a growing trend and an overwhelming number of U.S. citizens are giving up their American citizenship (citizenship abdications), which has been revealed by the U.S. Treasury Department. And, according to a survey conducted in early 2015 by deVere itself almost three quarters (73%) of Americans living overseas expressed the view that they were tempted to relinquish their U.S. passports.

Canada also is unhappy that the U.S. is engaging in an extraterritorial revenue grab.

Some 7m Americans outside the country (1m of them in Canada), along with an unknown number of “US persons”, are now caught in FATCA’s net. …Ms Hillis is fighting back through the courts. She and Gwen Deegan, an artist who has lived in Canada since she was five, filed a suit claiming that the Canadian government’s co-operation with FATCA violates a tax treaty and constitutional protections against discrimination. …If Ms Hillis and Ms Deegan win in court, Canada’s government will face an awkward choice between complying with the decision and exposing Canadian banks to huge penalties. The Alliance for the Defence of Canadian Sovereignty, which is paying the women’s legal expenses, has harvested donations from China, Vatican City and beyond.

These examples are why I wrote back in 2011 that Obama united the world…in opposition to bad US policy.

An article from CNBC highlights how bad the law is.

With an estimated 9 million Americans currently living overseas, the U.S expatriate community is comprised of a wide variety of people from all walks of life. ..The one nagging truth that is both common and unique to all of these individuals? They remain effectively fettered to the U.S. tax system. Unlike almost every other tax regime in the world, the U.S. taxes its citizens no matter where they reside. Thus, even if you expect never to return, you should expect to have to file an annual tax return. …As many expats can attest, it has become more difficult to open or maintain a bank account overseas without having to sign an IRS Form W-9 or other U.S. tax-related documentation. This increasingly common bank procedure is a result of the Foreign Account Tax Compliance Act, which requires foreign banks and other financial institutions, among other things, to gather and report information to the IRS about their U.S. customers or face stiff tax-withholding penalties on U.S. investments.

The last sentence is that excerpt deserves some attention. The FATCA law is so onerous that it is advantageous for many to simply not invest in the American economy.

And that means less growth and prosperity for the rest of us.

But that’s just part of the story.

Because the United States has imposed this awful law on the rest of the world, other nations now want to do the same thing. Indeed, the tax-aholics at the OECD have modified a Multilateral Convention and turned it into an Orwellian regime for promiscuous collection and sharing of data by almost every government. This scheme, sometimes referred to as the Global Account Tax Compliance Act because of its similarity to FATCA (I call it a nascent World Tax Organization), will boomerang on America because of the presumption that we’re obliged to change our tax and privacy laws so that foreign governments can tax investments in the United States.

Thankfully, Senator Rand Paul heroically is blocking this evil pact.

Let’s close with a semi-amusing description of FATCA.

[brid video=”118517″ player=”2077″ title=”FATCA Explained in 4 Minutes…”]

But if you prefer my more dour approach, here’s what I said a few years ago about FATCA for a Chinese network.

[brid video=”118518″ player=”2077″ title=”Dan Mitchell Commenting on FATCA and Misguided Fiscal Imperialism”]

I’ve been criticizing this awful legislation from the beginning. Hopefully Congress and the Trump Administration will give me one less thing to worry about.

Mike Breen / June 11, 2017

Americans that support this atrocity should hand their heads in shame.

/